The price of gold is down today.

$3346.24

The spot market for gold is open.

The price of gold is down today.

$3346.24

The spot market for gold is open.

| Type |

|---|

| Condition |

|---|

| Product Name | Price ▲ | Premium | Seller |

|---|

This table was last generated at 04:10 UTC on 2025-07-03.

Dirt Cheap Gold is a gold price comparison tool that helps you find the best deals on 1-ounce gold coins and bars from trusted vendors. Our bots search the internet for the lowest prices, so you don’t have to waste time checking multiple sites. We don’t use gimmicks—just straightforward, unbiased data. If you're looking for the cheapest way to stack gold, this is your go-to resource.

We automatically update deals every 30 minutes. The deals on this page are current as of 04:10 UTC on 2025-07-03.

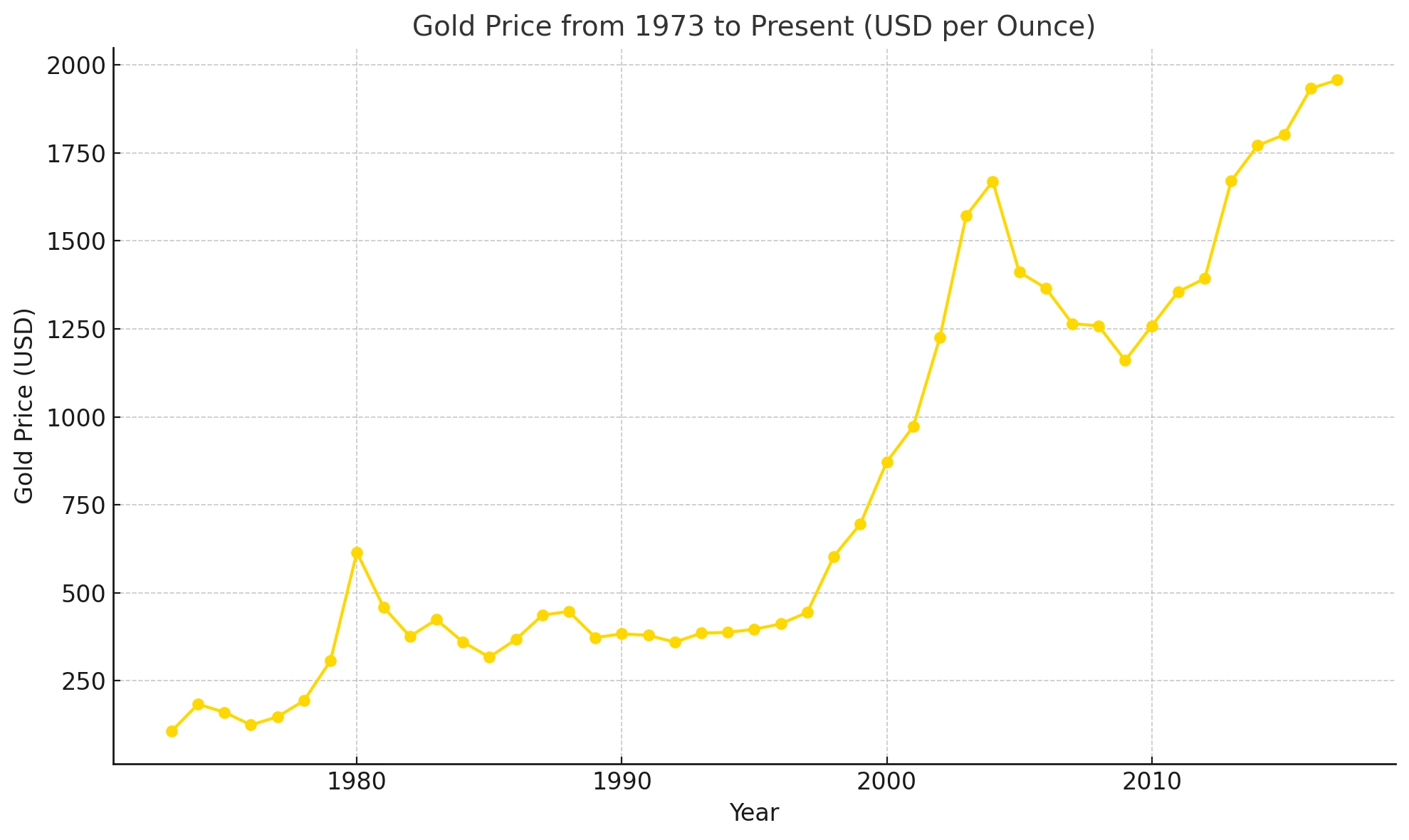

Gold has historically been considered a strong store of value, especially during times of economic uncertainty or inflation. Over the long term, the price of gold has steadily increased, reflecting its role as a hedge against currency depreciation and market volatility. While gold may not offer the same short-term returns as stocks, it tends to retain its value over time, making it a popular choice for preserving wealth. However, like any investment, its performance can fluctuate, and it's important to consider it as part of a diversified portfolio.

A stacker is someone who accumulates precious metals, like gold or silver, as a form of wealth preservation. Stackers typically prefer physical bullion such as coins or bars and focus on long-term investment strategies. The goal is often to "stack" as much metal as possible to protect against inflation or economic uncertainty. Most stackers aim to accumulate 5-10% of their net worth in metal.

Stacking starts with choosing the right type of gold for your collection. Most beginners opt for popular 1 ounce coins or bars like the American Gold Eagle or Canadian Maple Leaf. Make sure to buy from reputable dealers, compare premiums over spot price, and consider storage options like a safe or bank vault. Diversify your purchases over time, and be mindful of your budget, ensuring that you buy when the price aligns with your goals.

The gold spot price is the current market price at which one ounce of gold can be bought or sold for immediate delivery. It reflects the global price of gold in real-time, influenced by factors such as supply, demand, geopolitical events, and market speculation. The spot price is widely used as a benchmark in the gold industry and fluctuates constantly during market hours, which are primarily set by major commodities exchanges like COMEX.

The premium on gold coins and bars is the additional cost above the spot price of gold. This premium covers manufacturing, minting, distribution, and dealer costs. Coins tend to have higher premiums than bars due to their intricate designs and collectible value, whereas bars are usually closer to the spot price because they are simpler to produce.

We focus on 1-ounce gold bars and coins because they are the most popular and widely traded form of gold bullion. They offer a great balance between affordability and liquidity, making them ideal for both new investors and experienced stackers. Larger bars might offer lower premiums, but 1-ounce products are more flexible when it comes to buying, selling, or trading.

Costco began selling gold to members in 2023, offering 1 oz gold bars primarily through its online store. Executive members can enjoy a 2% discount, and using the Costco Anywhere Visa card adds an additional 2% cashback — a combined 4% discount that you'll receive later in the form of a rebate. These savings make Costco a competitive option for purchasing gold, though stock is often limited and sells out quickly.

Costco's products don't always appear in the main list on this page, but the table below shows all of the 1 ounce gold products currently available on Costco's website. The discounted prices of these products might make them competitive with products from other sellers.

| Product Name | Product Price | Discounted Price (4% Off) |

|---|---|---|

| 1 oz Gold Bar PAMP Suisse Lady Fortuna Veriscan (New in Assay) | $3400.00 | $3264.00 |

| 1 oz Gold Bar PAMP Suisse Diwali Lakshmi | $3400.00 | $3264.00 |

| 1 oz Gold Bar Rand Refinery (New in Assay) | $3400.00 | $3264.00 |

| 2025 1 oz American Buffalo Gold Coin | $3480.00 | $3340.80 |

Purchase from Costco or Walmart. Those sellers don't have higher prices or fees for credit cards.

Storing your gold securely is crucial to protecting your investment. Many stackers choose to store their gold in a home safe, but it’s important to ensure it is fireproof and bolted down. Alternatively, you can store gold in a bank's safe deposit box or a specialized vault service, which offers additional layers of security and insurance.

Whether you need to pay sales tax on gold depends on your location. In many states or countries, precious metals like gold are exempt from sales tax if purchased for investment purposes, especially above certain thresholds. It’s important to check local tax laws to see if exemptions apply where you live.

Selling gold is relatively straightforward. You can sell to local coin shops, bullion dealers, or on online platforms like r/Pmsforsale that specialize in precious metals. It’s important to shop around for the best offer, as prices and premiums may vary. Ensure you understand any fees involved before making a transaction.

The amount you can sell your gold for depends on the current spot price of gold and the type of gold you are selling. Dealers will typically offer you slightly below the spot price to cover their costs, and this is known as the buyback price. The condition and purity of your gold, as well as market demand, can also affect the price. Shop around for competitive offers, and always sell to a reputable dealer to get the best value.

A Matt Cone project. Made with 🌶️ in New Mexico.